There are a lot of things we can buy these days and obviously not enough money to buy them all. There are also emergency funds, unexpected expenses, education funds for kids and whatnot that can make personal finance management a time-sucking nightmare.

Enter some of the best budget apps that can help you institute financial discipline and control in your household, create a get-out-of-debt plan, manage expenses and the most important thing of all, stop living paycheck to paycheck.

Best budget apps for Android and iOS

There are numerous money management apps available for both Android and iOS, designed to make it east to keep your expenses in check, but also analyze your spending habits in order to create a realistic financial long-term plan.

With that said, here are some of the best budget apps available on Android and iOS with many of them having both free and premium plans for you to choose from.

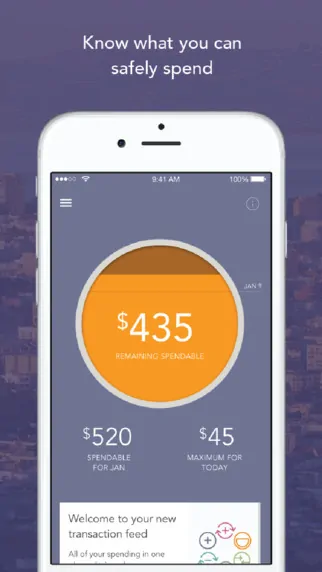

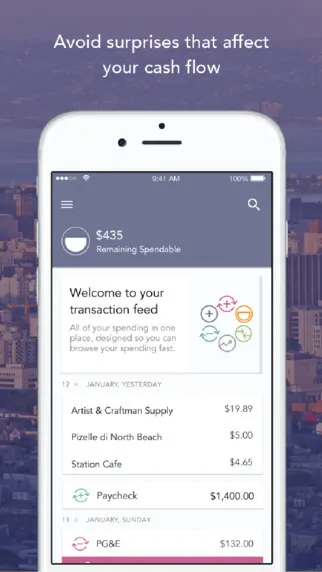

Level Money (Android, iOS)

Level Money is more than a money management app. Besides helping you input and track your financial status, the app also helps you set up a dynamic expense budget as well as analyze your spending habits.

It also allows you to connect your bank accounts and credit cards to retrieve information regarding all your transactions and deliver them in an easy to follow feed. You can also rest assured when it comes to keeping your data secure, as Level Money comes with 128-bit AES and SSL encryption and it’s access to your information is read-only.

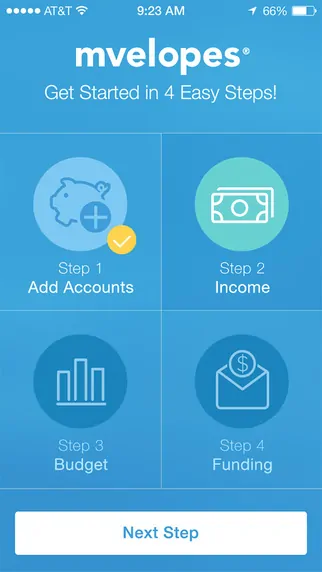

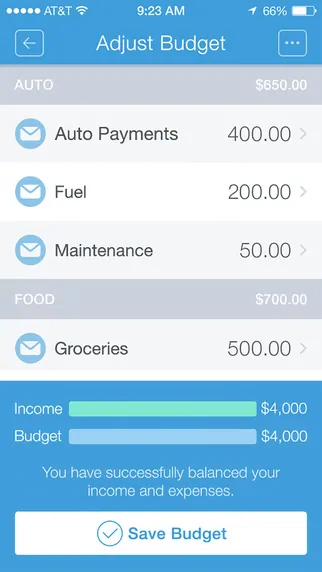

Mvelopes (Android, iOS)

Mvelopes has a stupid easy interface, so even if you’re not a financial expert it will be easy to track your income and expenses with this app. Linking a bank account is a simple process and if you’re a fan of the envelope method for budget management, the app offers it in its digital form – no paper required.

Also, Mvelopes offers dedicated app versions for Android tablets and iPads, which are designed specifically for larger layouts. The basic version of the app is free, although if you’d like to unlock premium features you can purchase a costly $95 yearly subscription. Just add that to your expenses.

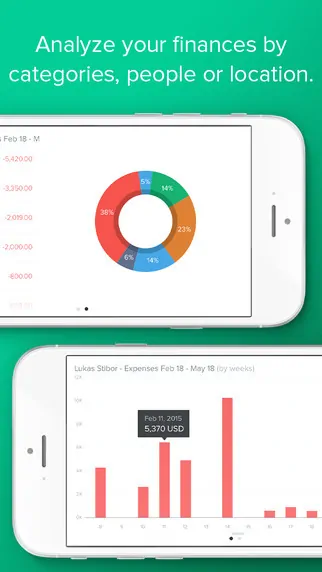

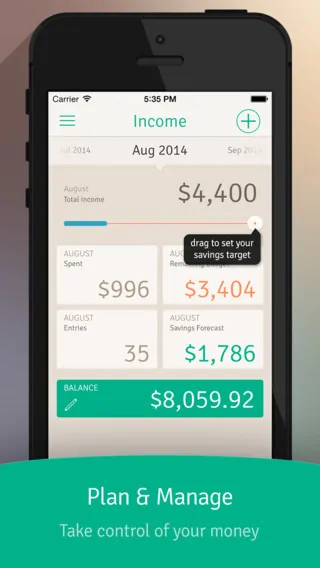

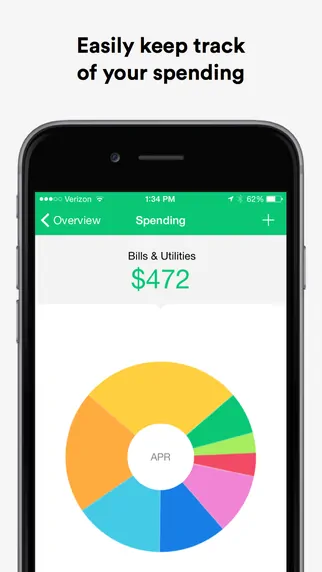

Spendee (Android, iOS)

If you’re a visual type of person you’re going to love planning your budget with Spendee, as the app shows you data in various colorful and easy to understand graphs and charts. The interface is also clean and straightforward and you financial tracking supports multiple currencies.

This way, you can rely on Spendee even when you’re visiting foreign countries, regardless if it’s for business or during a vacation. The app also has an interesting feature called ‘custom wallets’ which you can create to set aside special budgets for events like trips and weddings.

PocketGuard (Android, iOS)

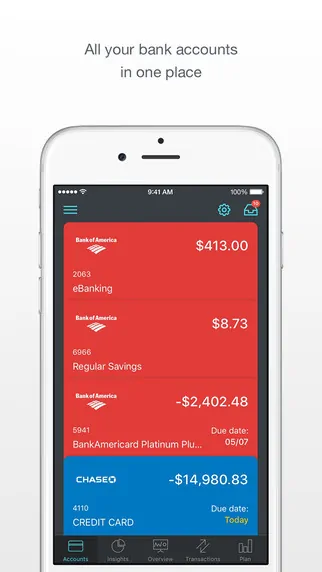

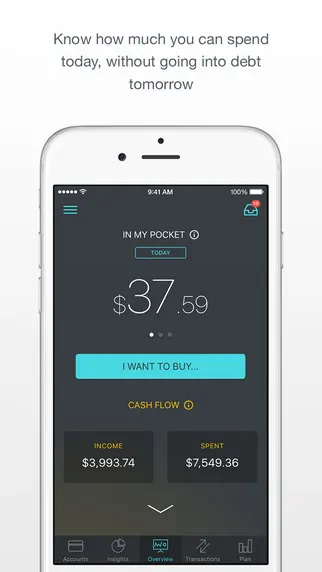

PocketGuard lets you easily connect your bank accounts and helps you manage your daily spending, cash flow, and bank balance.

Security is enforced by a 128-bit SSL encryption and the data coming from your bank accounts is set to read-only and protected by a 4-digit PIN code. Even if you prep a shopping list at home, it’s extremely easy to get carried away while shopping and to prevent overspending the app has a feature called ‘I’m going shopping’.

On top of that, PocketGuard lets you view cash flow and bank balance graphs, as well as set reminders for fees, paychecks, credit card payment due dates, charges, and billing subscriptions.

Wally (Android, iOS)

Wally is one of the few budget apps that is completely free to use. It’s not particularly complex but it is a reliable and friendly expense tracker that lets you fill in data by hand or by loading a photo of your receipt.

Provided you have location services enabled on your device, Wally will know where you are and fill in this information while you’re creating a new entry. Among other useful capabilities, Wally can notify you when you reach a savings goal, a bill is due or for other events you might need a reminder.

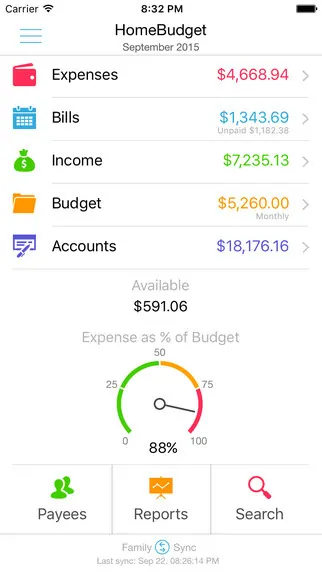

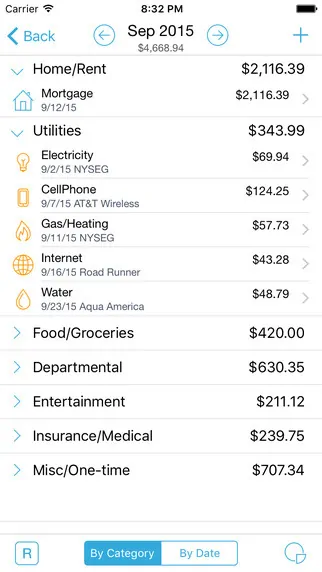

HomeBudget (Android, iOS)

HomeBudget is not a free app, you can buy it for $5 which might disappoint some of you. Nevertheless, for that price you will get one of the most feature-rich financial planning apps – it includes an expense tracker, budgeting features, as well as graphs, charts and other functions you can use to analyze your finances.

One of the most powerful features of HomeBudget is called Family Sync. It makes it possible for multiple devices from your household exchange financial data and they can even work on a single budget.

Furthermore, the app lets ou classify expenses, access list and calendar views of bills, attach receipt photos to expenses and much more.

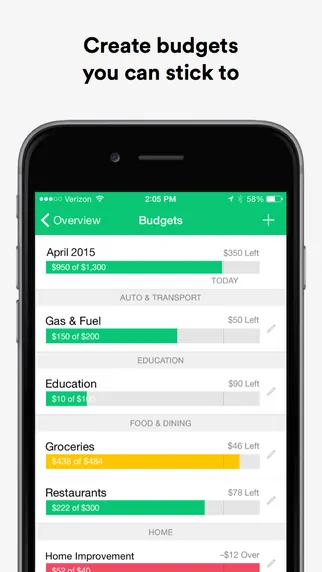

Mint (Android, iOS)

Mint is definitely one of the most popular budget apps, well appreciated for its modern and intuitive layout as well as a simple yet useful set of features.

The app lets you add all your accounts, credit cards, and investments to track all of them with ease. Mint offers the option to set bill reminders, and it can save you a lot of time by automatically sorting bank and credit card transactions.

What’s more, the app allows you to store your personal finances offline so you can access them even without an Internet connection and packs many more features that can simplify budget planning.

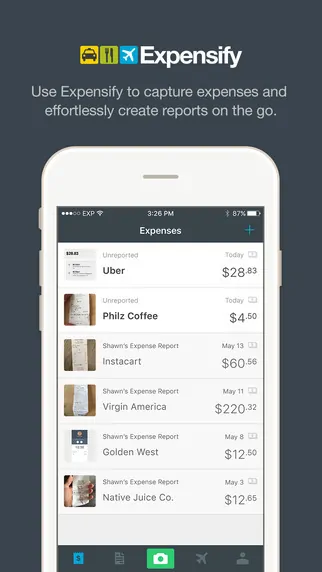

Expensify (Android, iOS)

If you need a reliable app to help you create expense reports with ease, you can rely on Expensify. This free app lets you track expenses manually, store receipt photos and import purchase data from your credit card to create IRS validated eReceipts at reasonable costs.

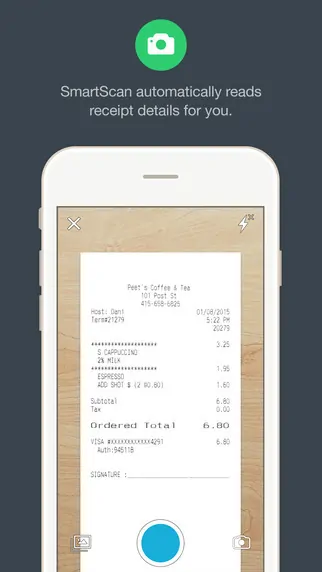

One of its most useful features is called Smart Scan and it lets you take a photo of a receipt which is detected by Expensify and automatically generates it as an expense.

These are some of the best budget apps currently available, but obviously, there are more available in the app stores, so if you know other reliable financial planning apps, share them with us in the comments section below!

Follow us on Facebook, Twitter and Google+ to stay up to date with the latest apps, games, guides and everything Android, iOS and Windows Phone.